Exploring Uniswap Mechanics and Key Features

Explore the advantages of using Uniswap’s real-time trading panel to streamline your crypto token exchange experience. This powerful interface allows users to execute trades effortlessly, ensuring swift transactions and complete transparency. Leverage this tool to make informed decisions and maximize your trading potential.

Utilizing a smart contract helper is crucial for navigating the complexities of automated trading on Uniswap. It simplifies the process of interacting with liquidity pools, allowing you to focus on strategy rather than the technicalities. By harnessing this feature, traders can minimize errors and enhance their overall performance in the market.

The integration of a blockchain pool log significantly boosts the analysis of liquidity and trading patterns. This feature provides insightful data, helping users identify trends and adjust strategies in real time. Monitoring this log empowers traders to stay ahead of market fluctuations and optimize their trading positions effectively.

Use the swap event tracker to stay updated on critical trading activities. This tool notifies users of recent swaps and changes in liquidity, enabling prompt reactions to market shifts. By incorporating this tracker into your trading routine, you’ll enhance your ability to anticipate and respond to market movements quickly.

Liquidity Pools: How They Work and Their Importance

Liquidity pools are fundamental to the operation of Uniswap, enabling seamless trades between crypto assets. These pools consist of funds contributed by users who provide liquidity. They earn fees from trades that occur within the pool, which incentivizes participation. The process is straightforward: a liquidity provider deposits equal values of two different tokens into the pool, facilitating the ability to exchange one token for another without the need for a centralized exchange.

Utilizing a gas fee prediction tool can help assess costs associated with transactions. Understanding the potential gas fees enhances decision-making regarding trade timing and execution. When using Uniswap’s token path explorer, users can effectively identify the optimal routes for token exchanges, ensuring they achieve the best prices and lowest slippage.

The Uniswap token search feature allows traders to find specific tokens easily. With this tool, you can access information about trading volumes and historical data via the token volume chart. Monitoring this data aids in making informed trading decisions. Additionally, insights from the blockchain pool log provide transparency regarding liquidity provision and associated fees.

For users wanting to manage their assets and trades more effectively, a web3 dashboard overview gives a snapshot of liquidity positions, current trades, and performance metrics. The real-time trading panel is crucial for executing trades swiftly as market conditions change, ensuring that users can capitalize on opportunities as they arise.

Moreover, the eth dashboard route significantly enhances the tracking of Ethereum-based token performance. Traders can evaluate their strategies based on smart contract interactions and liquidity trends. Cross-chain lp logs facilitate interactions across different blockchain networks, broadening the potential for earning yield on various assets.

Overall, liquidity pools not only foster a decentralized trading environment but also create opportunities for passive income through trading fees. Engaging with these tools and resources can lead to a deeper understanding of market dynamics and optimized trading strategies.

For more detailed insights on liquidity pools and their mechanics, visit Uniswap’s official site.

Automated Market Making: The Core Algorithm Explained

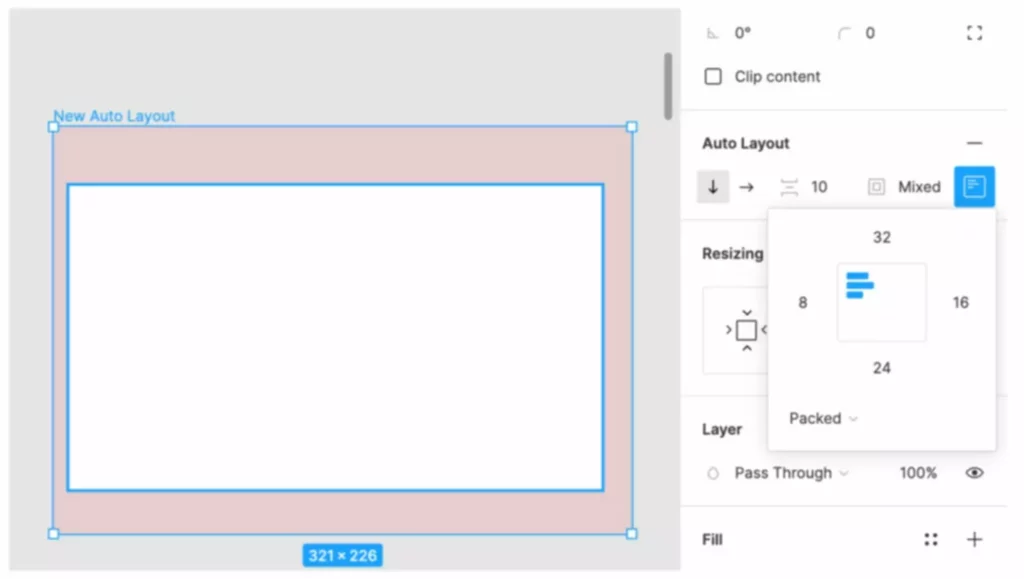

For those looking to engage with Uniswap, understanding its Automated Market Making (AMM) algorithm is critical. This algorithm allows users to swap assets directly through smart contracts. Using the swap calculator panel, traders can estimate trade outcomes and optimize their transactions.

The AMM operates on the principle of liquidity pools. In these pools, liquidity providers (LPs) deposit equal values of two tokens. The algorithm maintains the price based on the ratio of these tokens. A real-time trading panel displays current prices and transaction volumes, facilitating immediate decision-making. Each swap alters the token ratio, adjusting the price accordingly to balance supply and demand.

Managing gas fees is crucial for maximizing returns on trades. A gas fee manager helps traders estimate transaction costs, enhancing profitability. By monitoring gas prices and choosing optimal times for swaps, users can achieve better trading outcomes.

- Utilize the aggregator data hub to find the best prices across different pools.

- Check the token history log for insights on price movements and trading volumes.

- The crypto LP dashboard offers analytics on your liquidity contributions, showing potential returns from trading fees.

For cross-chain interactions, the web3 bridge monitor enables smooth transitions between different blockchain networks. This feature expands the trading options available for Uniswap users.

A smart contract dashboard provides an overview of active contracts, allowing users to see their positions and past trades. Understanding how these elements work together equips traders with the knowledge to navigate Uniswap effectively and make informed trading decisions.

Token Swapping: Step-by-Step Process for Users

Access your crypto lp dashboard to monitor the token pairs you want to swap. This tool provides insights into liquidity and real-time price movements, helping you make informed decisions.

Connect your wallet using the web3 bridge monitor. This ensures your wallet is linked securely to the Uniswap platform, allowing seamless interaction with smart contracts.

Use the liquidity pair scanner to locate the desired token pair. Input the tokens you wish to trade, and the scanner will display available pairs, their current liquidity, and trading volume. This data helps you identify the best options for swapping.

Review the token volume chart for recent trading activity. High trading volumes often indicate strong market interest, which can affect your swap outcome. Timing your swap based on these trends can enhance your strategy.

Once you select your pair, initiate the swap by entering the amount you want to exchange. A smart contract helper will assist in executing the transaction, ensuring it’s conducted smoothly and securely.

The gas fee manager will calculate the cost of your transaction. Adjust your settings if necessary to optimize fees while ensuring the speed of your swap. Confirm the gas settings align with your preferences before proceeding.

Finalize the swap by confirming the transaction in your wallet. Monitor the transaction status using your crypto lp dashboard to ensure everything goes as planned. Once completed, your new tokens will appear in your wallet, ready for use.

Impermanent Loss: Causes and Strategies to Mitigate Risks

To effectively manage impermanent loss while using Uniswap, leverage tools like the trading history helper and gas fee management options. By consistently monitoring price fluctuations through the price chart module, you can better anticipate impermanent loss scenarios.

Impermanent loss occurs when the price of tokens diverges in a liquidity pool compared to holding them in a wallet. This leads to potential losses in value when withdrawing assets from the pool. To minimize these risks, consider diversifying your liquidity provision across multiple pairs with correlated price movements. For example, tokens within similar market sectors often experience aligned price changes, reducing the impact of impermanent loss.

Utilize the token volume chart to assess trading patterns. Increased trading volume might suggest higher volatility, prompting a review of liquidity positions. A gas fee prediction tool helps gauge transaction costs during withdrawal, allowing you to time your movements effectively.

Incorporate an aggregator data hub to evaluate various liquidity pools. This will provide insights into potential returns while factoring in risks. Additionally, employing a smart contract helper ensures your liquidity strategy is sound and aligns with current market conditions.

Analytics play a pivotal role; a wallet analytics board can provide personalized insights into your liquidity position and exposure. Regularly assess your overall portfolio to determine which strategies yield the best outcomes while limiting exposure to impermanent loss.

| Strategy | Description |

|---|---|

| Diversification | Invest in multiple correlated token pairs to minimize volatility impact. |

| Market Monitoring | Use price chart modules for anticipating price changes and trends. |

| Cost Management | Utilize gas fee prediction tools to minimize transaction costs. |

| Analytics Tools | Leverage wallet analytics and aggregator data for informed decision-making. |

By integrating these strategies and tools into your liquidity provision practices, you will be better equipped to face impermanent loss head-on while enhancing your overall trading experience on Uniswap.

Governance Features: Voting Mechanisms in Uniswap

Uniswap enables its community to participate in governance through a robust voting mechanism. Token holders wield power to propose and vote on protocol updates, ensuring the platform evolves according to user interests. Utilizing a voting contract, users can submit proposals related to liquidity pools, fee structures, and even new features for the uniswap exchange route manager.

A key aspect of Uniswap governance is the delegation of voting power. Token holders can delegate their voting rights to other users, allowing for broader participation without requiring constant engagement. This strategy encourages investment from those who may lack the expertise to participate directly in governance decisions.

Real-time trading panels provide transparency and immediacy, making governance easier. Users can access data from the aggregator data hub to analyze the impact of proposed changes on trading efficiency across liquidity pairs. A liquidity pair scanner supports informed voting by showing historical performance that helps gauge the potential benefits of new proposals.

The fee estimator tool allows participants to understand how changes in governance decisions might affect transaction costs. This feature is invaluable, especially for large-scale traders and liquidity providers who rely on precise estimates for their operations.

History logs capture voting patterns and results, creating a token history log that community members can reference to inform their future votes. Consequently, the voting process is not only transparent but also anchored in measurable outcomes from past governance actions.

Furthermore, integration with a web3 bridge monitor enhances interoperability, thereby broadening governance participation across different blockchain networks. Users can track their wallets and decisions through a wallet tracker app, ensuring they remain informed about their investments and governance stake.

In summary, Uniswap’s governance features, coupled with tools like the crypto exchange monitor, empower users through informed decision-making and continuous engagement in the protocol’s evolution. Participate actively, vote wisely, and help shape the trajectory of your uniswap experience.

Comparing Uniswap with Other Decentralized Exchanges

Uniswap stands out for its user-friendly features such as the crypto LP dashboard, which allows liquidity providers to monitor their positions effortlessly. In contrast, many decentralized exchanges lack such intuitive interfaces. Evaluating token path explorers, Uniswap provides an efficient way to visualize potential routes for token swaps, ensuring users make informed decisions while trading.

The real-time trading panel is another defining feature, enabling traders to track market movements and execute trades promptly. Other exchanges may not offer such immediate insights, leading to delayed transactions and loss of potential profits. With the swap calculator panel, users can quickly estimate slippage and fees before executing trade, enhancing the trading experience significantly.

Uniswap’s swap event tracker further enriches its platform by allowing users to monitor liquidity changes and trade activities efficiently. This transparency fosters trust and informed trading. Many competitors fail to provide similar tracking, which can leave traders without critical information.

Additionally, the blockchain pool log ensures users have access to historical data regarding liquidity pools. This feature is often overlooked by other platforms, yet it empowers traders to analyze market conditions better and make more strategic decisions. Finally, the web3 dashboard overview simplifies interactions with various smart contracts, making it easier for users to engage with DeFi protocols.

In summary, Uniswap’s combination of advanced tools and user-centric design sets a high standard that many other decentralized exchanges struggle to match. Its array of features promotes a seamless trading experience, making it a preferred choice for both novice and seasoned traders. Exploring these elements can significantly enhance one’s trading journey in the DeFi space.

Q&A:

What is Uniswap and how does it function?

Uniswap is a decentralized exchange (DEX) that allows users to swap various cryptocurrencies without the need for a centralized authority. It uses an automated market-making system, which relies on liquidity pools rather than traditional order books. Users can trade directly from their wallets, and the exchange relies on smart contracts to facilitate and secure these transactions. Liquidity providers contribute assets to pools, enabling users to swap tokens while earning fees from the trades that occur within those pools.

What are the key features of Uniswap?

Uniswap offers several key features that make it distinct and user-friendly. First, it operates on the Ethereum blockchain, leveraging smart contracts for secure transactions. Second, it allows users to trade a wide variety of tokens without pre-established market pairs, thanks to its liquidity pools. Additionally, liquidity providers can earn transaction fees proportional to their share of the pool, creating a passive income opportunity. The platform is also accessible directly through wallet integration, providing users with a seamless trading experience without the need for account registration.

How does liquidity provision work in Uniswap?

Liquidity provision on Uniswap involves adding an equal value of two tokens to a liquidity pool. When a user provides liquidity, they receive LP (Liquidity Provider) tokens that represent their share of the pool. These LP tokens can be traded or utilized for other purposes, such as farming or staking on different platforms. As trades occur using the pool, liquidity providers earn a portion of the transaction fees generated, which incentivizes them to maintain liquidity within the system. However, providers should be aware of impermanent loss, which can affect the overall return on their investment depending on price fluctuations between the pooled tokens.

What are the potential risks of using Uniswap?

While Uniswap offers advantages like decentralization and ease of use, there are inherent risks associated with its use. One major risk is impermanent loss, which can occur when the price of the tokens in a liquidity pool diverges significantly. Additionally, there is exposure to smart contract vulnerabilities, as any bugs or exploits could potentially impact user funds. Furthermore, market volatility can lead to large price swings, making it crucial for users to conduct thorough research and risk assessment before participating in liquidity pools or trading on the platform.

How does Uniswap differ from other decentralized exchanges?

Uniswap distinguishes itself from other decentralized exchanges primarily through its automated market-making model rather than relying on order books like many traditional exchanges. This mechanism allows users to trade any ERC-20 token directly against liquidity pools without needing a counterparty. Additionally, Uniswap has a unique fee structure where liquidity providers earn a fixed percentage of transactions in the pool, motivating more users to contribute liquidity. Other decentralized exchanges may have different models, such as limit orders or specialized token listings, influencing their operational dynamics and user experiences.

What are the main features of Uniswap that make it unique?

Uniswap stands out primarily due to its automated market maker (AMM) model. This allows users to trade tokens directly with smart contracts instead of relying on traditional order books. The liquidity pools are another key feature; users can provide liquidity in exchange for a portion of the trading fees. Uniswap also facilitates seamless token swaps with minimal friction, allowing for easy integration of new tokens. Furthermore, the platform’s decentralized nature means that users retain control over their funds, enhancing security and privacy.

How does the pricing mechanism work on Uniswap?

Uniswap utilizes a unique pricing algorithm based on the constant product formula, which is represented as x * y = k. In this equation, x and y are the quantities of two tokens in a liquidity pool, and k remains a constant. When a trade occurs, the price of the tokens adjusts automatically based on the proportion of the tokens in the pool. For example, if someone buys a token from the pool, the amount of that token decreases, resulting in a higher price for subsequent trades. This dynamic pricing approach ensures that trades influence the token prices directly, reflecting real-time supply and demand.