For individuals who remain some thing simple, you could potentially receive sixty,000 issues for starters cent per area for a couple redemptions, along with 600 in the cash back otherwise 600 within the current notes. You might knock you to definitely really worth by reservation travel because of Chase Take a trip, use the weblink SM as the Sapphire Common will provide you with a 25percent added bonus in these redemptions. There’s no common code, however, spreading out your apps the 3 to 6 months is actually constantly an intelligent move. It gives their borrowing from the bank time to get well and provides your eligible for lots more offers later on. Welcome bonuses are a great way to locate a jump-start a great redemption you happen to be targeting.

Greatest charge card acceptance bonuses recently

An earlier incentive given the brand new examining users the opportunity to secure a good two hundred Pursue bank account added bonus by the opening a good Pursue Total Examining membership and you will appointment conditions. If the you can find head deposit standards, analysis paychecks and other resources of income meet with the minimums? When you have to care for a particular balance or done a great certain level of purchases, are you currently in a position to logically fulfill those individuals conditions? You can also have the ability to qualify for one or more incentive regarding the same financial, however, which depends on the financial institution’s formula. Often, a lender will allow users to profit of multiple now offers, as long as they’re for different membership versions.

SoFi’s on the internet savings account indeed rewards people to possess paying and you may preserving. The fresh account, and therefore increases while the a checking and you will family savings, makes you organize your own discounts on the vaults in order to functions to your your aims. You’ll secure as much as 3.80percent APY to your cash in discounts and up to 0.50percent on the checking financing.

Normal website visitors who appreciate luxury benefits including couch availability and you may who can be optimize the newest card’s redemption possibilities and you may annual take a trip credit are able to find that it credit definitely worth the price of possession. Catch up on the CNBC Select’s in the-depth visibility from handmade cards, banking and currency, and you may pursue all of us for the TikTok, Twitter, Instagram and Twitter to remain advanced. Credit cards sign-right up extra is actually a reward to entice people to open up a great the newest bank card and make purchases for the credit. Your generally must purchase a quantity within a selected several months to make the benefit. To ensure you could hit the spending threshold as opposed to overspending, look at your credit card report over the past few months or perhaps the season. This will leave you smart out of exactly how much your should expect to invest on the the new credit.

He’s ages of expertise inside digital and you will print news, as well as stints since the a copy dining table captain, a cable editor and a metro publisher to your McClatchy newsprint strings. Thankfully, there are numerous traveling perks cards with charge away from under 100, plus particular which have 0 annual charge, you to definitely pack an effective strike. Eventually, you should consider the new yearly commission on the any benefits card one you unlock. Some of the greatest take a trip benefits notes fees annual costs, and so they can range around a lot of money per year. But when you wanted the flexibleness to use their things or kilometers while the you desire comes up, you might opt for transferable things otherwise miles such those individuals you earn to the Pursue Sapphire Well-known and/or Amex Gold.

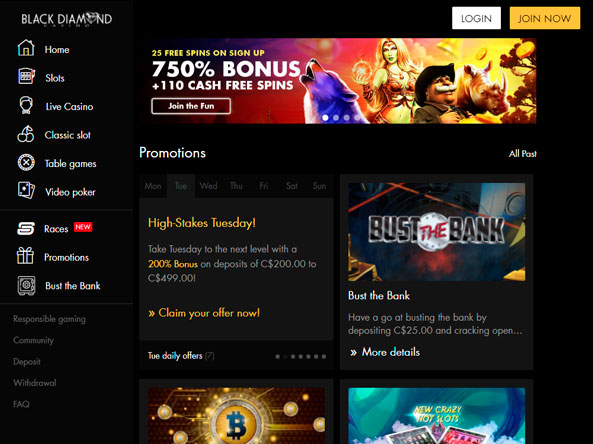

- Such as, online slots typically lead a hundredpercent of your bet to your wagering demands, making them an ideal choice for fulfilling such criteria.

- All of the 31 MLB groups have been in step for the Saturday evening, which means that there needs to be one thing for each basketball lover.

- You can also begin making purchases prior to your credit comes playing with a good digital credit count to function on the the fresh greeting bonus.

- At the time of creating this short article, financial institutions for the high discounts greeting incentives try PNC and You.S.

- Financial institutions wear’t constantly build searching for this type of advertisements easy, therefore here are some tips to assist you in finding banking institutions having promotions and now have your hands on those funds bonus.

- Bankrate features partnerships with issuers along with, but not simply for, American Express, Lender from The usa, Funding You to definitely, Pursue, Citi and see.

No Fee CHEQUING Account

When looking for a different mastercard, it may be appealing to choose a cards with fancy travel advantages including airport couch availability, a totally free TSA PreCheck subscription otherwise automated elite reputation. But if you’re perhaps not an everyday traveler, you may get much more play with broke back advantages more than take a trip benefits. That said, devote some time evaluate SoFi Examining and Offers which have checking accounts and high-produce discounts membership, and you can evaluate prices or other has to find the right fit for your requirements. The brand new Wells Fargo Way2Save Deals also provides one of several high incentives to your a checking account that people discover, although it demands a very large minimal deposit from 25,000 in the very first week.

Greatest Savings account Incentives away from July 2025

In the Craig Newmark Graduate University away from News media from the City College of brand new York where the guy worried about team revealing. Indeed there he had been awarded the fresh Frederic Wiegold Honor for Organization News media. He made his undergraduate education of Ny School.Taylor even offers done the education requirements on the University out of Texas to be eligible for a certified Financial Planner certification.

Our very own finest selections of quick offers from your people

The new card_identity most recent added bonus now offers a supplementary step one.5percent money back on the 20,100000 from using via your first year—really worth as much as three hundred money back. Learning to convert these types of added bonus points thanks to a supreme Rewards-making card can lead to a lot more benefits—once you learn an educated strategies for the fresh issues. For individuals who’ve currently had the newest cards, the newest rewards you earn won’t getting twofold. Yet not, it’s it is possible to to try to get the newest credit again by the “device altering” your existing cards_term to some other credit, for instance the Chase Versatility Flex℠ or even the cards_name.

What’s the Minimum Put to possess Fanatics Sportsbook?

If you have anything else you need to find out about the brand new promo, app otherwise how to make your account, make sure to here are some our very own Fanatics Sportsbook FAQ lower than. Fans ordered PointsBet and its complex technology to possess 225 million in the Summer 2023. With this purchase, Enthusiasts Sportsbook was created, performing a wedding between PointsBet’s advanced wagering tech and you will shelter, and you will Fanatics’ highest brand name feel. Popular put steps one to processes instantaneously without any deal charge try PayPal and Apple Pay. Bank transmits and you can wire transfers are cost-free, that have wiring usually using up in order to couple of hours in order to techniques. Fanatics Sportsbook brings users with lots of expert and you will university sporting events groups in order to bet on.

When you can move you to, you’ll delight in sophisticated customer support and you can a supplementary to dos,100 on your own pouches. Once you go after all requirements, you’ll discovered your own bonus inside 40 weeks. We love the new access to 15,000+ ATMs and you will cuatro,700 twigs, plus the insufficient fees.

Disregarding Small print

It’s not tend to, whatsoever, that you will find paying that may equate to making many out of thousands of things otherwise kilometers in the a short span. And that bank card is best for your relies on what you spend really money on each month and you will what kind of tourist you’re. You earn an additional evening after using 29,one hundred thousand on the purchases to your card inside a season and you can a third nights immediately after spending 60,100 to the card inside a season. I generally merely follow the incorporated totally free night but nevertheless get amazing worth from it.

The realm of Hyatt Mastercard are surprisingly rewarding since the rewards you have made might be used in the preferred prices due to the world of Hyatt’s big honor graph. Information about Discover notes has been collected individually by the CNBC See and has maybe not been analyzed otherwise available with the new issuer previous to help you publication. Intro percentage out of either 5 or 3percent of one’s level of per transfer, any is better, in the first two months. Then, either 5 or 5percent of your amount of for each and every transfer, almost any try greater. The fresh Platinum Credit of Western Share is actually for those individuals seeking take a trip inside deluxe and you can make the most of large advantages on the eligible airfare and hotel expenses.

You could receive directed (and you can highly rewarding) acceptance incentive offers on your own email. I just utilized my personal take a trip credit for the a stay in the a coastline resort inside my home town out of San diego come early july, shaving of a serious part of the cost. The fresh card provides for to help you 199 inside statement loans for each and every twelve months once you purchase Obvious As well as involved (at the mercy of vehicle-renewal). In addition there are either a 120 report borrowing to have International Entryway the couple of years when spending with your card otherwise a cards of up to 85 to possess TSA PreCheck all cuatro step one/couple of years when using along with your cards. Obviously, the newest highest-avoid redemptions I’m searching for need a lot of things, but which card makes it easy to tray them upwards thanks a lot in order to its multiple incentive categories. The brand new Chase Sapphire Well-known produces 2 items for every money used on travel, that has a great deal of orders such as flight tickets and resorts stays.